Asian evolution

Andrew Catchpole reports from WBWE in Yantai on the booming bulk market and fast-evolving Chinese taste for wine

With the latest UN estimates putting China’s population at 1.4bn and a fast-growing aspirational middle class turning on to wine, it’s little surprise that crunching numbers on the growing consumption tends to throw up some pretty impressive figures.

What is perhaps less widely understood, though, is quite how fast Chinese consumer preferences are evolving. It’s worth looking at some of those numbers as a backdrop to this fast-changing scene.

Currently the market for wine in China is the third most valuable in the world, behind the US and France, according to recent research by Australian consultancy Wine Business Solutions. However, and despite a small dip in market value in 2018 (mainly due to changing laws regarding gifting), the general upward march of wine consumption looks assured.

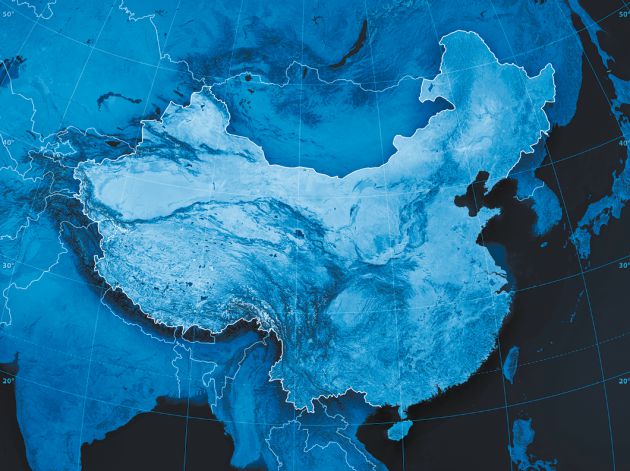

Now worth £13.1bn annually, China’s market for wine is predicted to grow to £15.4bn by 2022. Further IWSR data, presented at the recent inaugural World Bulk Wine Exhibition Asia (WBWE) in Yantai – a port city in Shandong province where around 85% of imported bulk enters the country – places China as the fifth-biggest bulk importer globally, but with volumes up from 31m litres in 2000 to 176m litres in 2018.

Moreover, while bulk volume to China still sits behind Germany (615m litres in 2018), France (543m litres), the UK (500m litres) and the US (251m litres), both bulk and bottled imports are predicted to continue on this upward trajectory, with China (followed by Hong Kong) the fastest-growing bulk import market in the world.

Add to this equation WBWE and IWSR analysis, which shows China as a market where premium sales are on the increase (by the end of May 2019 bulk imports

had already reached half the value of spend in 2018), and the attraction for the world’s collective producers is obvious. Tap into China, do it well, and the rewards can be high.

↓

Changing tastes

With all eyes on China, though, and the world’s wine supply back in better balance after the vintage shortfalls of 2017, producers would do well to consider how Chinese tastes are changing, and changing fast, if they are to succeed in the longer term.

Speaking at a roundtable hosted by wine consultant Natalia Posadas-Dickson at WBWE Asia, Chinese winemaker Li Li Tang, who produces the newly fashionable Marcellan variety, described this evolution. “The Chinese have woken up to wines they like – fresh, with bright fruit, acidity (half of China likes vinegar, so their palates are atuned to high acidity), low or no oak, more natural wines,” said Tang.

“Ten years ago everybody talked about Bordeaux style in China, and thought Bordeaux style was [the] high-quality style – including winemakers, not just consumers.”

This, though, said Tang, is fast changing, with differing styles of wine flooding into China from around the globe, exposing consumers to a far greater range of styles than ever before.

“We began to realise that it’s not true and so the style is changing, winemakers [in China] are starting to change their own style with different character… so now we can see the taste profile of the Chinese consumer preference developing,” said Tang.

She referenced recent research from Shanghai University looking into the flavour profiles preferred by Chinese consumers, with more than half of those surveyed preferring fresh, easy-drinking wine, and only 25% liking oak notes.

Drill down into these trends and the results are instructive. Dan Traucki, an export consultant working with Wine Assist out of Australia, spoke of “significant opportunities” in the China and wider Asian markets at the moment, with a big shift going on in terms of the styles of wine that bulk buyers are looking for.

“There’s going to be more acceptance of varieties other than classic French, with a greater role for white wine – we are now shipping 20-25% white wine for our clients, a big increase and growing, and it goes better with a lot of the food,” said Traucki.

“Big reds have been traditional, but a younger generation is looking for different varieties and I believe it will be closer to 50:50 white and red in China in the future.”

Traucki added that while China is on course to double its domestic wine production over the next five years, growth in consumption will stay abreast of that increased volume, meaning that imports will remain strong for the foreseeable future.

Moreover, as Jerome Busato, chief executive officer of French bulk supplier Château Cohola, highlighted, this growing confidence to buy wines that drinkers like, rather than wines they thing they ought to like, is happening with some speed.

“China has learned more than anybody else before about wine in the past 10 years,” he said.

“Here they judge by pleasure. In France we think, sometimes, we have to adapt [to the wine], but here, it’s a question of the wine having to adapt to pleasure if our wines are to be commercially successful.”

What emerges is a picture of a market that, while still in its relative infancy, is growing up fast. And, in doing so, China is moving towards the very same trends that are sweeping the western wine-drinking world, with fresher, easygoing styles of red and white, with less oak, softer tannins and lower levels of alcohol, becoming the wines of choice.

As Posadas-Dickson, who directed the content programme at WBWE Asia, said: “The potential, the size of the market, the opportunities, the fact it’s a new market coming in, people want to learn – how could you resist being here?”

It’s a sentiment that rings true for an increasing number of producers around the world, with the Chinese wine market now broadening to encompass the individual and new.