WSTA asks government to end ‘doom loop’ as duty to rise

The WSTA has called on the government to end the “doom loop” caused by its decision to continue to increase alcohol duty at the last Budget (as Harpers reported).

Read more...

The WSTA has called on the government to end the “doom loop” caused by its decision to continue to increase alcohol duty at the last Budget (as Harpers reported).

Read more...

Data from the Office for National Statistics (ONS) has revealed that the hospitality sector employed 8,784 fewer people in December 2025 compared to November 2025.

Read more...

Last week’s reports that pubs will see great business rates support has been followed by a chorus of industry figures urging the government to extend the relief to all of hospitality.

Read more...

Trying to extract any optimism from the autumn Budget is potentially a fool’s errand. Alcohol duty will increase in line with RPI – a move many in the sector had pleaded with the government not to make. With RPI currently set at 3.66%, according to the WSTA, this will see duty go up 11p on an average bottle of Prosecco, 13p on a bottle of red wine and 38p on a bottle of gin. This, combined with the cumulative strain of the inflationary pressures of the past five years on consumer buying power, will likely continue to inhibit spend on alcohol.

Read more...

The Society of Independent Brewers & Associates (SIBA) has sent an open letter to Chancellor Rachel Reeves, expressing its “deep concern” that the hospitality sector was facing a “crisis of survival” after the recent Budget.

Read more...

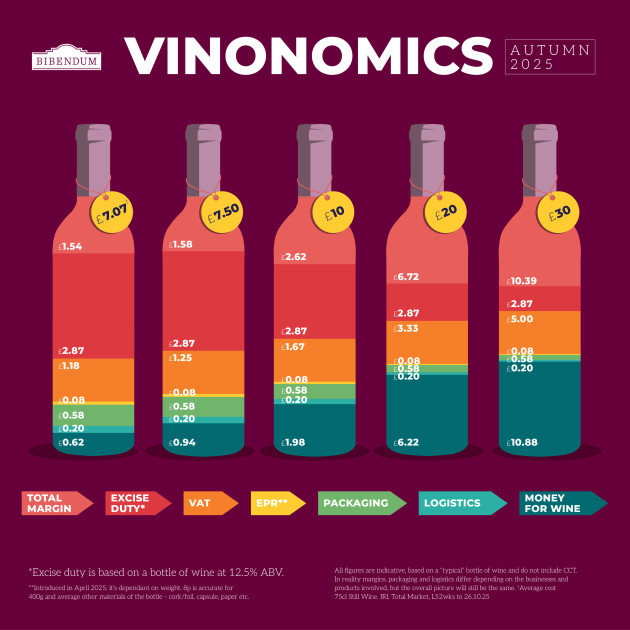

The premium wine distributor Bibendum has released a new ‘Vinonomics’ graph (pictured) which breaks down the different costs that make up the price of a bottle of wine, following the Autumn Budget.

Read more...

In an entirely predictable move, Chancellor Rachel Reeves has confirmed that alcohol duty will rise with the Retail Prices Index (RPI) in 2026, provoking near-universal concern across the drinks trade.

Read more...

New figures from The Insolvency Service show that company failures in the hospitality sector were essentially unchanged in September 2025 – and only slightly higher year-on-year – as operators await next week's Budget.

Read more...

More than half of UK hospitality businesses are anticipating further layoffs and/or price rises if the upcoming Budget fails to deliver urgent support, according to a new joint survey.

Read more...

Trade body UKHospitality has called for action ahead of the upcoming Budget in an open letter backed by 345 hospitality businesses.

Read more...

Writing about the state of the drinks trade over the past year, it can be hard not to get drawn towards a general sense of gloom. Amid the frustration at a raft of government policies that have unfairly hamstrung the sector, from off-trade to on, one thing that has become clear is the industry is willing to fight for a fairer legislative landscape. The recent revelation that duty receipts have been in decline despite the February tax hike shows that those frustrated across the wine and spirits world were lucid in their critique. Calls for change are all the more vital at present given the Budget is due to be announced on 26 November. Harpers sought the perspective of leading industry figures before the government’s next key policy announcement.

Read more...

UKHospitality has projected that a total of 111,000 hospitality jobs will have been lost by the Budget on 26 November.

Read more...

The Wine & Spirit Trade Association (WSTA) has published a ‘go-to guide’ for the industry, aimed at helping policy makers and politicians “better understand” the UK wine and spirit market.

Read more...

With the latest ONS labour market figures showing the number of payrolled employees in hospitality down from 2,111,898 in April to 2,100,827 in May, UK Hospitality is calling for urgent government action.

Read more...

UK Hospitality has warned the Prime Minister that hospitality is in danger of being taxed out, with the sector having lost 69,000 jobs since the Budget.

Read more...

The first Labour-backed Budget of the new government is expected to have a significant impact on the balance sheet of popular pub group J D Wetherspoon, just as the company was on track to return to steady growth.

Read more...

The UK Spirits Alliance (UKSA), representing 300 distillers, has written a letter (read below) to Rachel Reeves urging her to champion the gin trade rather than burden it with further duty rises this February.

Read more...

The introduction of 40% business rates relief for hospitality venues in Scotland with a rateable value of up to £51,000 will be a welcome introduction for many but could see more than 2,500 businesses ineligible for the scheme.

Read more...

With the aim of providing clarity for the trade, James Bayley once again highlights what’s coming down the line.

Read more...

The government of South Africa has published a policy review on the taxation of alcoholic beverages, with plans to increase excise tax in the forthcoming 2025 Budget.

Read more...