Not too big to fail: Where it all went wrong for Conviviality

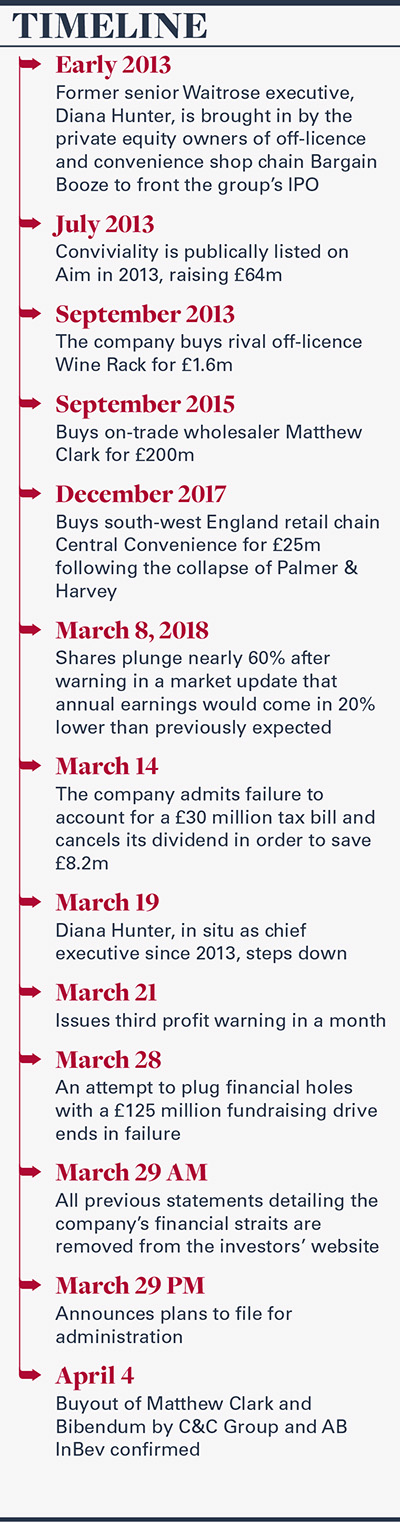

With annual sales of £1.6bn and shares flying high at 425p each on the stock market at the end of 2017, Conviviality seemed to be more than keeping its head above water in the choppy seas of today’s difficult trading environment.

Three profit warnings and a flummoxing £30m tax bill later however, the trade – much of which buys from or supplies to the wholesaling giant – finds itself wondering how it all went so badly wrong.

Cracks in the company’s finances first appeared at the beginning of last month, when the Bargain Booze and Matthew Clark owner warned that its full-year profits would be 20% below market expectations.

At the time, the company put this down to an “arithmetic error” in the financial forecasting of its Conviviality Direct business - a statement which would turn out to be the first of several downplaying the seriousness of the troubles faced by the UK’s biggest alcohol supplier.

What was dubbed a small-scale accounting error took on much larger significance a week later, when the company issued its second profit warning and admitted to an unforeseen tax bill of £30 million.

The suspension of its shares followed, and the company cancelled its dividend to save £8.2 million.

Another attempt at damage control then couched the £30m funding gap as a “short-term challenge”.

But things went from bad to worse with Diana Hunter’s exit as CEO and the failure of a £125m equity fundraiser leading to the announcement that the company would to file for administration within ten business days “unless circumstances change”.

Mid week, news emerged of Magners owner C&C Groups’ successful bid, in partnership with brewing giant AB InBev, to acquire Matthew Clark and Bibendum PLB, providing a glimmer of stability to Conviviality’s 2,500 employees whose jobs still hang in the balance.

But even with the buyout confirmed, the future remains uncertain for Conviviality’s sprawling retail and wholesaling arms, which supply 23,000 outlets across the UK’s pub, retail and hotel/restaurant sectors, with the collapse into administration likely to cause disruption for customers and suppliers for a long time to come.

In the crosshairs

While the company was equally praised and criticised for its growth ambitions following the 2013 IPO, spurred on by Hunter’s success with turning around corner-shop retailer Bargain Booze, few will disagree the collapse of the UK’s biggest alcohol wholesaling empire is a sorry state of affairs: not only for suppliers, customers and employees, but also for the industry itself, which has had its fill of uncertainty – economic and otherwise – in the past few years.

Like many, Robin Copestick, managing director of Copestick Murray, finds himself on both sides of the fence as both an interested party, supplying to Bargain Booze and Matthew Clark and also as a competitor, vying for trade alongside PLB.

“In the short-term, the concern is the money that we’re owed and how that will work with insurers,” he said.

“But in the longer term, it’s disappointing for the industry. With Palmer & Harvey, that’s easily the two biggest suppliers of alcohol going out of business in the last two years. Hopefully, this will be a wake-up call up to the fact that suppliers need decent margins. We need to work much harder to be sustainable.”

Keywords:

- Conviviality

- profit

- CEO

- company

- tax bill

- Profit warning

- unforeseen tax

- accounting error

- £30m funding gap

- unforeseen tax bill

- second profit warning