Sherry president outlines opportunities for growth

Sherry has attracted its fair share of negative headlines in recent years, with its steadily declining volumes making it an easy target to highlight shortcomings in the wider alcohol industry.

Sherry is by no means alone in the struggles it faces, with Port and Vermouth also facing volume decline.

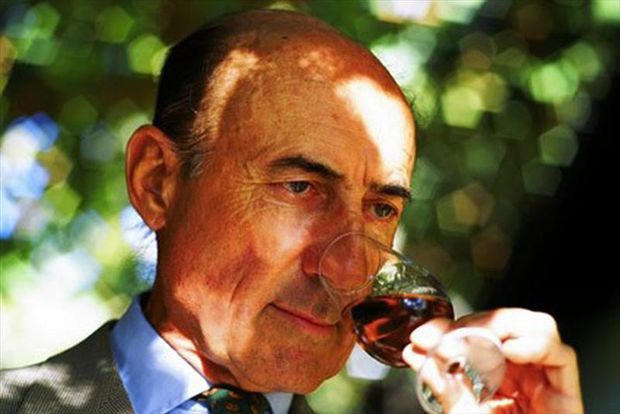

Beltran Domecq, president of the Consejo Regulador de D.O. Jerez/Sherry, has plenty of ideas of how to drive the category forward.

But before we can look ahead to what lies in store for Sherry in 2017, first we must understand its past.

In the UK, moreso than any other of its exports markets, Sherry has garnered a split identity which traditionally has more to do with Christmas Eve and quintessentially English festive cheer than its Spanish roots.

But despite having less of a defined role in our drinking culture, Port continues to out-sell Sherry, with nearly two thirds of fortified wine drinkers drinking Port compared to two out of five, which drink Sherry.

Men tend to favour Port, while women are more likely to opt for Sherry.

Other statistics point to how the Sherry dynamic is changing in the UK.

Speaking to Harpers following his masterclass at Heart of Spain last week, Domecq pointed to a divide between Sherry drinkers, where the drink is gaining traction with the younger generation at one end and the older generation at the other.

This is backed up by WSTA figures, which found that younger fortified wine drinkers have more in common with older ones than the mid-generation: 41% of 18-24 year old fortified drinkers, and 44% of the 55s and overs, drink Sherry.

This divide also points to a dichotomy between the anglicised version of Jerez and its popularity with the older generation and young, hip consumers sitting in London's trendy Sherry bars, which have grown out of Spainish restaurant boom in the UK on-trade.

But in terms of dominant style, which sits at the sweeter end of the spectrum, it's the same for all age groups.

"In the UK, 65% of consumption is cream and pale cream, whereas in Spain the opposite it true. In Spain, 84% consumption is dry styles like Fino and Manzanilla," Domecq explained.

Dramatic change

One thing that can't be left out of this picture is Sherry's dramatic decline.

In 2015, Sherry sales fell to 7 million litres (almost 10 million bottles) compared to 16 million litres (over 22 million bottles) in 2005, more than halving the volume sold in a decade (WSTA figures).

Domecq says there has been some traction in the UK since then, with a modest rise in consumption since the autumn despite strikes in Jerez affecting traffic in the UK.

"People don't stock pile anymore. Transport is so good now that they don't need to," Domecq observed.

Going forward, a primary focus for Domecq and the board is increasing promotion and encouraging further promotional spend.

The Consejo is investing between €1.5 and 2m euros this year, predominantly in its main markets: Spain, the UK and the US.

But as well as using its own budget, Domecq wants to encourage less reliance on the board for promotional activities and see producers and retailers taking a more proactive stance.

"Our promotional activities are negotiated and funded in conjunction with producers, but companies need to do more themselves," he said.

One of the promotional activities was the Sherry masterclass as Heart of Spain last week, where Domecq looked at the science behind Sherry's evolution.

Next up is the June final of Copa Jerez, the international food and Sherry pairing competition involving seven of Sherry's top export markets.

Premiumisation

Effective promotion and as well as the effect of premiumisation could spell success for Sherry going forward.

As drinking habits - especially in the younger generation - show a growing preference for quality over quantity, the possibility of growth in Sherry-based cocktails also presents opportunities.

"Sherry in cocktails is unorthodox, but it's becoming a good way to introduce people to it. Young people like something that's different and going to be important to Sherry's future," Domecq observed.

But where Sherry fits on the shelf and how to market the fruits of its complex Solera aging system is still problematic.

As Domecq said: "If you put a Fino and Manzanilla with white wines, then they sell better than if they were with the other Sherries."

The growing foodie trend, the boom in the Spanish restaurants in the UK and bars like Veeno which champion the European Aperitivo culture, also present opportunities for widening Sherry's appeal.

But again, there are some misconceptions around food-pairing and Sherry's image as a digestif which need to be addressed before Sherry can find its place within this larger movement.

"Fortified wines are seen as after dinner drinks, but they should definitely should be drunk with food," Domecq insisted.

"Not only are they higher in alcohol, they also pair well with all sorts of food. Fino with oysters at the beginning of a meal is delicious and perfectly balanced."

Sherry as a typical pairing partner for cheese is also up against competition from red wine - something which Domecq believes is misjudged.

"The idea that red wine is thought to go well with cheese, is completely wrong. The tannins in red are too strong, they completely kill the flavours of the cheese," he said.

Again, it comes down to communication.

Plenty to consider when putting that promotional budget to good use.

Keywords:

- wine

- News

- European Wine News

- Wines by type

- Sectors

- Sherry

- Wines from Spain

- Spain

- Jo Gilbert

- HWS - Jo Gilbert