Scottish minimum pricing to impact over half of alcohol sales, while wine and premium spirits could benefit

Wine and premium brands could be the big winners of Scotland's impending minimum price legislation, it has been revealed.

Pending a legal challenge by the Scotch Whisky Association (SWA), the Scottish Government's delayed bill could have a major impact on the Scottish alcohol industry, where at least 50% of alcohol currently doesn't meet the impending minimum 50p per unit price legislation.

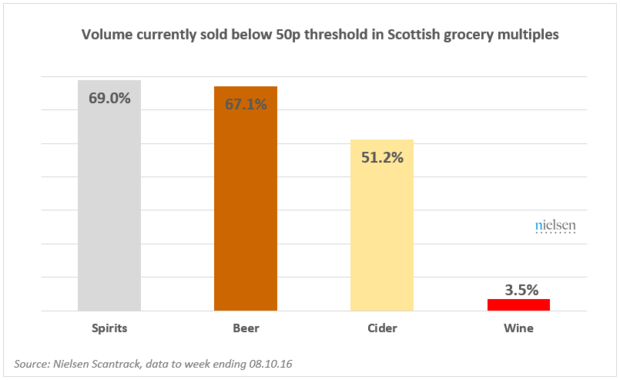

Spirits will be the most impacted as 69% of volume currently sold is below the 50p per unit threshold, according to measurement company Nielsen which analysed till sales (EPOS data) in nearly 1,200 stores in Scotland.

Beer is the next most impacted (67% of volume is below the threshold) followed by cider (51%).

However, wine and premium brands - particularly in spirits - are likely to benefit as the difference in price between premium and cheaper brands diminishes.

According to Nielsen, wine has the "most to gain" as only 3.4% of wine sales would be affected.

When looking at the top 50 selling products in each category, instead of total volume sales, 76% of the most popular spirits don't meet minimum pricing compared to 74% in beer, 54% in cider and 12% in wine.

"Wine is, by far, the least impacted and so has the most to gain from minimum pricing," Marika Praticó, senior client manager at Nielsen, said.

"Overall, wine will need to raise prices by the least amount, thus, it becomes more affordable relative to other alcohol."

The Scottish Government has said that the alcohol problem in Scotland is so significant that "ground-breaking measures" are required.

In May 2012 it passed legislation that would enable it to introduce a minimum unit price for alcohol, but the intended price of 50p per unit has not yet been implemented due to a legal challenge from the SWA.

Blended scotch and vodka are the two categories impacted most by minimum pricing legislation.

Blended scotch, overall, will require prices to rise 20% to meet the threshold, while vodka requires a 16.3% rise.

Enforced price rises aren't necessarily disastrous for the spirits industry however, as they could result in increased revenue - as long as demand doesn't fall beyond a certain "tipping point".

"This break-even figure is 12.5%, as long as any potential decline in demand doesn't exceed this the industry will benefit thanks to the higher price point. Should demand fall by more than 12.5%, that's when their revenues will decline," Praticó explained.

One potential implication of minimum pricing could be that consumers are increasingly likely to trade up to more expensive brands, which is likely to have a negative impact on supermarkets' own-label offerings.

This could sound the death knell of major price-saving deals offered by retailers in spirits, beer and cider, as the likes of two-for-one deals would mean the effective price paid for each unit of alcohol would fall below the threshold.

In terms of buying behaviour, experts are predicting an increase in cross-border alcohol shopping among the Scottish to England and Ireland, where prices would be cheaper.

Stockpiling before the legislation comes into force could also mean a bumper Christmas for alcohol retailers.

Keywords:

- wine

- News

- Trade Bodies

- Spirits by type

- Sectors

- Whiskey

- Vodka

- Spirits

- Finance

- Jo Gilbert

- HWS - Jo Gilbert