Up to 95% of suppliers demand retailers change the way they work with them

Up to 95% of the 200 suppliers who took part in our survey into the behaviour of major UK retailers want them to change. Here Gemma McKenna reveals what suppliers really think of the big multiples

Up to 95% of the 200 suppliers who took part in our survey into the behaviour of major UK retailers want them to change. Here Gemma McKenna reveals what suppliers really think of the big multiples.

How retailers treat their suppliers has been front-page news ever since Tesco admitted to a £263 million black hole in its profits last autumn. To assess what suppliers really think of the major retailers, Harpers asked them to fill in an online poll over Christmas either anonymously or by name.

The response was overwhelming with over 200 suppliers taking part. Their message was resounding. A staggering 95% of respondents said the sector needs urgent reform into how grocery retailers do business. But, worryingly, only four in 10 suppliers thought there was a chance any real changes will be made.

Tesco's position goes from bad to worse as it was singled out as the worst retailer to work with - well ahead of its rivals - with 32% of the vote.

There have been grumbles for some time from across the wine supply base about how difficult managing relationships with the major multiples can be, and how demands, and contracts, can be changed on very short notice. But there was little hard information to go on until "TescoGate" broke in late September 2014.

The subsequent £263 million shortfall in profits - explained by supplier fees being accounted for in the wrong periods - turned a national spotlight on to this thorny issue. At first suppliers were quiet, and reticent to admit that problems extended to wine and spirits. But when the global head of beers, wine and spirits, Dan Jago, was suspended in October, the issue came home to roost.

With government ministers and MPs asking questions and now a full-blown Serious Fraud Office inquiry into Tesco's dealings with suppliers, there has never been more public scrutiny over the transparency of retailer and supplier relations.But let's not pretend the question of fairness in dealing with suppliers extends only to Tesco. To assess what suppliers really think about the issue and the steps they would like to see taken to make relations better, we asked them to take part in our open survey.

How important are multiples to suppliers?

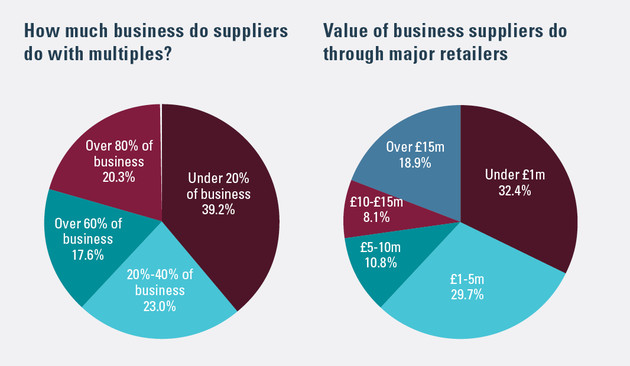

Two-thirds of respondents said they work with major retailers, with 40% of those saying they work with four or more of the major retailers. Four out of 10 respondents say listings with the multiples account for under 20% of their business, with 23% saying it accounts for between 20% and 40%, 18% saying it accounts for 60% of business and one in five saying multiple listings account for 80% or more of their total business.

How much business do you do with major multiples?

When it comes to how much those listings are worth - the most popular answer was less than £1 million - true for one-third of respondents. But a further 30% say it is worth between £1 million and £5 million, while 19% say it counts for over £15 million of their sales.

Which is the best retailer to work with?

Sainsbury's comes out on top as the best retailer to work with, scoring positively with 19% of respondents, while Morrisons is the preferred retailer for just 1% of suppliers, and Asda for only 4% of those questioned.

Sainsbury's comes out on top as the best retailer to work with, scoring positively with 19% of respondents. Tesco is the worst with 32% of suppliers

Majestic and Marks & Spencer also did well, with 14% of suppliers approving of them. Lidl, Aldi, Oddbins and Laithwaite's all got mentions from suppliers when asked to suggest other preferred retailers.

Which is the worst retailer to work with?

Way out in front as the least favourite retailer to work with was the beleaguered Tesco. It was selected as the worst offender by a whopping 32% of respondents, with its nearest rival for the title, Majestic, lagging behind with 19%.

Do you work with discounters?

Last year was the year of the discounters with sales growth of 20% and over at Aldi and Lidl. But their smaller ranges and lack of brands have made it difficult for wine suppliers to gain a foothold, with just one third of respondents saying they are working with the discounters.

The fairest retailer?

When it comes to knowing where you stand with retailers, suppliers rate Marks & Spencer as the fairest operator. It got 18% of the vote, but was closely followed by Sainsbury's, on 15%, falling to 11% for the Co-op.

When it comes to knowing where you stand with retailers, suppliers rate Marks & Spencer as the fairest operator, closely followed by Sainsbury's

Bottom of the tree was Majestic, which secured only 3% of the vote as the fairest retailer.

Who offers the most support?

Paradoxically, given it was rated as the worst retailer to deal with, Tesco is named as offering the best support to suppliers by 22% of respondents. Perhaps this illustrates the strength of Tesco's consumer franchise, and how it allows its producers/suppliers to interact directly with its customers. Last year saw more than 15,000 members of the public attend Tesco's Wine Fairs - and it remains the only major retailer to engage with the public on such a grand scale. Tesco also works hard to engage with consumers via its Wine Community online. M&S also scores highly (16%) when it comes to supporting suppliers, with discounters down the list.

Who asks for the most financial support?

Tesco was found to be the worst offender in this category, with 57% naming the supermarket as asking for financial support. Almost half (48%) of suppliers said the same was true of Sainsbury's, while the discounters were named by only 5% of respondents.

Best chance to increase listings?

Suppliers looking to increase listings feel their chances are greatest with Majestic (17%), closely followed by M&S and Tesco, both at 15%.

Interestingly, it is the best-performing retailers that are least likely to offer opportunities to grow listings. The chances aren't great at Waitrose or the discounters, with only 2% and 3% respectively looking to bump up listings there.

Most important factors in negotiating with retailers?

A good margin, transparency and a strong relationship with the buyer were rated as the most important factors when it comes to negotiating with retailers, with volumes least vital.

What's more, seven out of 10 respondents said it's getting harder than ever to deal with retailers now, with reasons given ranging from "buyers being generally fixated on price", intense competition rendering the process a "zero sum game", "squeezed margins", a lack of experienced buyers, and "very one-sided deals."

Suppliers on why it is getting harder to deal with retailers

"Each retailer can set their own price/promotional mechanism and they have become increasingly complex. Annual joint business plans have now become the norm but buyers usually come back later in the year asking for more promo budgets making it difficult to plan/budget effectively."

"Buyers generally fixated on price, promotions and margin rather than meeting shopper needs."

"Due to worldwide competition wine is more and more considered as a commodity where origin is no longer important."

"The buyers are not specialists in their field and are moved on to another category before any meaningful traction can be gained. The strategy from the top does not seem to cascade down. There are no guarantees or commitments and retailers will do anything to ensure they are not in any way liable for anything that may go wrong."

"Consolidation of supply base. Increased cost of business. Confused and changing promotional strategies. Less interest in quality."

"Their demands for financial support remove a huge amount of margin and the business becomes close to becoming unviable."

We asked suppliers if they had anything else to get off their chests

"Retailers are making it more and more complicated to deal with them. They need to simplify the way they deal with NPD and with pricing/promotions and stick to the agreed joint business plans."

"We think (or would hope) that 2015 will see more interest in smaller specialists like us; less of a stranglehold by the supermarkets; a move away from mass produced, cheap wines by the public as they begin to learn more; greater understanding by the public of how supermarkets operate."

|

Keywords:

- News

- Producers

- Retailers

- Marks & Spencer

- Sectors

- Suppliers

- Morrisons

- Sainsbury's

- Tesco

- The Co-op

- Harpers Subscriber

- Analysis & Insights

- Majestic

- Analysis

- Gemma McKenna

- HWS - Christine Freeman

- Harpers Reports

- Aldi

- Lidl