Cash crisis looms as businesses call for reform to “lip service” relief packages

Companies are calling on the government to reassess its package of relief support which they say doesn't go far enough, fast enough, to help cash-strapped businesses through these turbulent times.

The word unprecedented is often overused. Not so in the current situation, with the coronavirus (Covid-19) outbreak leaving countless businesses, in the hospitality industry in particular, with no choice but to close overnight.

This leaves restaurants and bars in a uniquely vulnerable position.

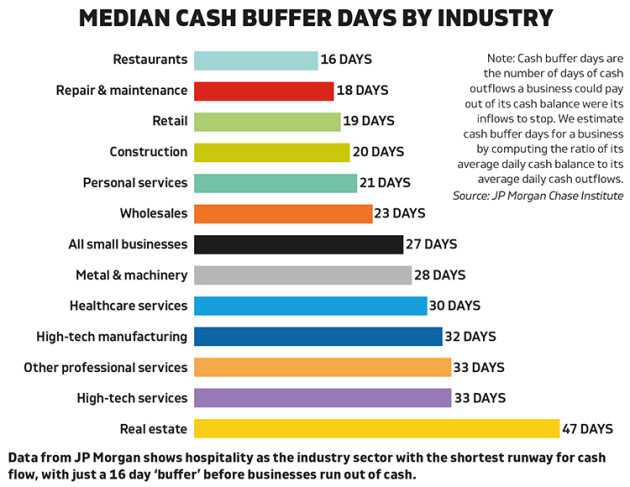

According to JP Morgan, the UK on-trade is especially dependent on cash flow - more so than other industries - with most having just a 16 day runway to fall back on before their coffers run dry.

When the crisis hit, chancellor Rishi Sunak was widely praised for putting in place a wage safety net for both PAYE businesses and the self-employed via the Job Retention Scheme (JRS) and a number of other schemes to support businesses, too.

However, faced with income falling abruptly to zero, businesses are now still having to foot the wage bill for furloughed employees until they are reimbursed by the JRS (to be backdated to 1 March, with first payments going out, at the earliest, at the beginning of May).

The choice is simple, business say. Make changes for relief measures to become more swift and accessible, or face widespread collapse.

“The government made a big fuss about imploring businesses to not lay people off and it would do whatever it takes,” said Vagabond MD Stephen Finch.

“It is to be commended for its efforts, but the timing must be better. Otherwise businesses that tried to hold on to furloughed staff will have no choice but to lay people off, and of course, it takes cash to lay people off. Make no mistake, very few businesses will have loads of cash lying around.”

The JRS isn’t the only initiative set up by the government to ease businesses through the worst of the crisis.

So far, there has been some assistance offered by the pause of VAT. From 20 March to 30 June 2020, businesses won’t have to pay VAT (deferred until end of tax year 2021), which will help to boost cash flow. There is also the 12-month business rates holiday for all businesses, regardless of rateable value, removing the previous £51,000 cap.

But when it comes to the Coronavirus Business Interruption Loan Scheme (CBILS), cash grants and also the rent forfeiture moratorium, businesses have used words such as “deeply flawed” and accused them of paying “lip service” to the plight of businesses, while lacking the teeth to make a real impact.

“As CBILS is based on the very faulty EFG scheme, it’s unlikely much of the ballyhoo’d £300 billion will find its way to deserving SMEs, particularly not in the time they need it,” Finch continued.

“The fundamental flaw is trying to route the funds via the banks. It really needs to be direct from the Bank of England.

“The cash grants are great, but largely penalise London SMEs, most of whom will have rateable values greater than £51k. In a sense the grants are targeting regions of the country far less impacted than London which is the epicentre.”

Then there’s the rent forfeiture moratorium.

According to property lawyer Paul Jagger, partner at hospitality specialists Glover Solicitors, “The rent forfeiture moratorium is providing breathing space for companies by allowing them to not pay rent for three months without risk of eviction.

“However, landlords can still utilise Commercial Rent Arrears Recovery (CRAR), and issue statutory demands, which is a precursor for a winding up petition to force a company into insolvency.”

“The government passed the rent forfeiture moratorium to encourage landlords and tenants to negotiate a settlement,” adds Finch. “Because other coercive options like CRAR exist, that objective is ephemeral at best.”

The knock-on effect for suppliers are palpable. At Hallgarten & Novum Wines, where 75% of business relies on supplying the premium on-trade, “The ability of many of our customers to pay us is severely limited”, said MD Andrew Bewes.

“We are, however, all very much in the same boat. Good communication has, and will continue to be, key here – the fact that many of our loyal customers and suppliers have been working with us for a long time has allowed us to find the right balance,” he added.

What’s clear is that, when it comes to debt, we’re in uncharted territory. There’s no doubt that the current situation is a major headache for the trade, and one that may, in the end, only be relevant for a few months before falling by the wayside. There’s a hell of a lot of good will out there. In the end, that’s what may see many businesses through these trying times.

NB: More from Kate Nicholls, CEO UK Hospitality on the issues above:

“Cash flow, or the lack of it, is the major issue for many businesses. The government has announced welcome support but it is not yet filtering through to businesses, many of which have little time to spare. They are closed or operating a severely reduced, service but are still expected to pay bills. The hope was that the moratorium on commercial landlord sanctions and debt enforcement would encourage landlords, suppliers and businesses to work constructively and collectively.

"Businesses must be cut some slack by landlords and suppliers, not least so that their trade and rents are there in the future. As the initial problem of what to do with team members has been dealt with, businesses are looking at how to exist over the coming weeks and months, so that they can resume when the crisis has passed.

"It helps nobody if businesses are squeezed in the meantime. We have been discussing with government how to provide breathing space at such a difficult time. Changes announced this week to insolvency law, something UKH suggested, look like they should give businesses some slack from creditors for a period of time while they restructure.”

For more on this issue, refer to the April print edition of Harpers, out today, or our digital edition here.

There is also more information and guidance about the JRS at www.gov.uk.

Keywords:

- People

- Business

- Government

- MD

- VAT

- businesses

- scheme

- business rates

- choice

- crisis

- cash

- lay

- jrs

- lay people

- cash flow

- “lip service”

- month business

- scheme cbils cash

- loan scheme cbils

- interruption loan scheme

- coronavirus business interruption

- business interruption loan

- CBILS

- EFG