Burgundy reaches record prices and market share in 2018

Burgundy hit record highs both in terms of prices and market share in 2018 following the region’s relentless rise in the past decade.

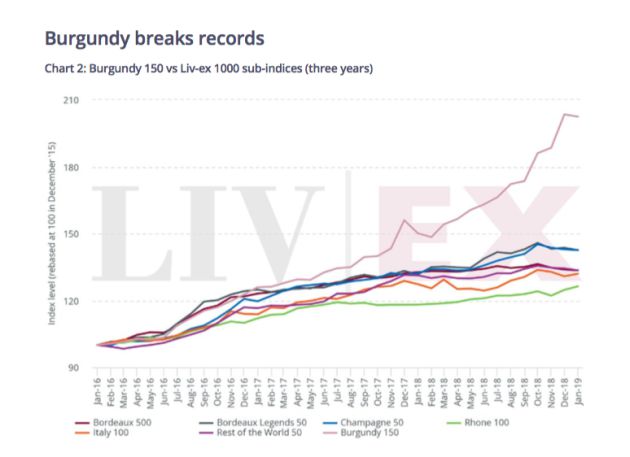

The Burgundy 150 index, which tracks the price movements of the most active Burgundy wines in the secondary market - principally Grand Crus, has climbed a staggering 168.8% since 2010, according to Liv-ex’s latest Burgundy report.

At the same time, the region has moved its market share from 1% to 14.5% boosted by a growing worldwide interest in Burgundy, with the secondary market for the region remaining unshaken by event that have affected global financial markets, according to the Burgundy – In the spotlight report, which explore the development of the Burgundy market over recent years and the factors that influence price.

In 2018, 1,585 unique wines traded from 847 brands, according to the report. The total value traded also continued to rise, while Burgundy’s exposure – the total value of bids and offers – a measure of its liquidity, surpassed £9.4 million, it revealed.

While headlines have focused on DRC – of which two bottles of Romanee Conti 1945 broke records in October last year becoming the most expensive wines ever sold at auction, Burgundy’s success has not been limited to this brand, said Liv-ex.

“Burgundy dominated the Power 100 – our annual list of the world’s most powerful fine wine brands. As the star of the show, 29 of its labels were featured, and it accounted for 14 out of the top 20 price performers. Leroy was in the top spot, while Dujac – favoured by the American DJ Khaled – was the biggest price riser.”

Looking ahead, the report said there were some signs that the record-breaking price rises could be facing some headwinds.

“With fewer buyers at these stratospheric prices, Burgundy prices are beginning to show increased volatility – often a sign of a turn. This month’s Burgundy campaign for the 2017 vintage, which is set to be the largest since 2009, will be a test of the region’s new price levels,” predicted Lix-ex.

In fact, Liv-ex suggested this year’s En Primeur campaign might “influence, if not change”, the landscape.

“Burgundy, famous for its scarcity and exclusivity, has produced a high-quality and high- quantity vintage across both red and white wines. The current market release could generate a mixed response. It might benefit well-known brands that typically command high prices, as Burgundy has seen a trend of collectors following winemakers rather than vintages.

“At the same time, the impact on less famous labels and village level wines might be less positive as the enlarged production could sit on the market for longer. Still, as high supply goes, Burgundy’s volumes seem modest in comparison to Bordeaux and other regions.”